Nvidia is one of the few companies to transform the investment landscape in a world characterized by artificial intelligence innovations and international technological competition. With a market cap of $4.1 trillion by the beginning of July, 2025, Nvidia has risen to the stars and left many investors wondering: Will Nvidia be among the leaders in 2035, or is there a threat of disruption?

It is not a hot chip story or a quarterly result. It is the story of a corporation in a triangulated game between innovation, geopolitics, and an unquenchable thirst of computing power. The following is an in-depth analysis of what might be in store about Nvidia stock in the next one decade and the reasons why investors always remain vigilant?

Modern Era of Nvidia

The recent successes of Nvidia are difficult to pass unnoticed. Its AI chips have turned into the spine of data centers and the golden child of the modern tech boom. During the first quarter of 2025, an astounding 89% of the Nvidia sales of $44.1 billion was related to AI and data center sales, a fact that underlines its control over a market that every tech titan and startup desires.

In July 2025, the big headlines were that, in a surprise move, the Trump administration had given Nvidia a green light to resume selling H20 AI chip sales to China. This is not just a monumental increase of revenue since the chunks of revenue that were pre-threatened amounted to a figure of $8 billion quarterly but, it also gives Nvidia a lifeline into the quickest advancing AI market the world has ever seen.

The company now has a chance to recover most of a recent $4.5 billion impairment charge related to a pile of unsold inventory and overstock. However, although such victories provide a short-term boost, the situation 10 years later leads to some thorny questions.

The Economics Trench behind Nvidia

It is not the sheer strength of its hardware that keeps Nvidia on top but rather the ecosystem that has grown around its CUDA (Compute Unified Device Architecture) programming platform. The dominant position in the AI and machine learning workloads of CUDA has served as an effective moat against competitors in the United States as well as expansion into other parts of the globe. The Chinese market is an exceptional challenge.

Nvidia by supporting Chinese customers ensures that domestic rivals such as Huawei do not create a walled garden of AI processors, a phenomenon that may, in future, pose an existential threat to Nvidia. However, this is at the mercy of constantly changing political winds in the US, which poses a risk as national security relations wax and wane.

The Dangers

To put into perspective, Nvidia has a current gross margin of over 70% which means that it is selling chips at a premium that is much higher than the cost of production. Nevertheless, these margins seldom survive in technology.

Large firms such as Alphabet, Amazon, and OpenAI have been investing intensively in custom silicon that are specialized to address their own massive processing demands. By developing in-house solutions, Nvidia faces the risk of not only the margin compression but also losing some share to these largest buyers.

The overdependence on one sector is also dangerous. Nvidia is extremely vulnerable should the rate of AI investment slow down or if other computing architectures materialize within the next ten years as nearly 90% of its sales are tied towards data centers and AI hardware.

Opportunity Zones

The company is not stagnant. Nvidia has already started to funnel their expertise into new directions. Its auto and robotics unit also are not a marketing asset only, with sales in that segment rocketing by 73% YoY to total $567 million in the Q1 2025. The new markets bring with them enormous untapped revenue bases as mechanical transportation and humanoid robot options become increasingly viable.

Besides, Nvidia is betting early on quantum computing. It has research centers in Boston and Japan and is attempting to position itself to be in a position to take advantage should and when quantum advances generate new demand on bleeding-edge hardware.

The Problems and Risks

The longest roads do lead to the end and even the most successful corporations are victims of their own success when it comes to a company priced to perform years of flawless growth. The shares of Nvidia may now be traded at 55 price-to-earnings (P/E) multiple, whilst compared to the average of the S&P 500. The implication is that Wall Street thinks that Nvidia will be almost perfect in its delivery for years to come, and that is not a lot of room to maneuver.

This level of valuation implies that even in case Nvidia resumes growing, the multiple expansion probably would not be fast. Those days of 100%-plus yearly growth enjoyed by investors over the last several years are likely over unless Nvidia can come up with a new must-have product line or massively diversify beyond AI chips.

What Recent History Tells Us?

To understand the potential of Nvidia, it is important to consider the growth of people who early invested in it. In April 2005, the same investment of $1,000 in Nvidia would have yielded over $1 million now, beating investments on other tech-heavyweights like Netflix by the same period.

But history cautions that there are numerous industry leaders out there that looked invincible at some point- IBM to Nokia-then becoming overshadowed. From its initial public offering at $12 a share in January 1999 through December 2020, NVDA stock created $309.4 billion in shareholder wealth, according to an analysis by Hendrik Bessembinder, a finance professor at the W.P. Carey School of Business at Arizona State University.

The Future Path

We cannot be sure of the stock price of Nvidia in the year 2035 but depending on some real and measurable factors the direction of stock price shall be set. Such as Nvidia’s future success hinges on several strategic imperatives. The company’s ongoing access to the Chinese market remains crucial not only as a major engine for raw sales growth but also as a way to exert competitive pressure on global rivals and prevent them from gaining similar scale of advantages.

Diversification efforts, especially advancements in automotive, robotics, and quantum computing are essential to reduce risk and broaden Nvidia’s revenue base beyond its current dependence on AI and data center hardware. To stay ahead in an increasingly commoditized landscape, Nvidia must ensure that its CUDA platform and broader developer ecosystem continue to evolve rapidly, reinforcing its software and R&D advantages. Ultimately, to prevent stagnation in its stock price despite solid operational results, Nvidia will need to consistently achieve or surpass the extraordinary expectations set by investors, anchoring its lofty valuation to demonstrable and sustainable innovation-driven growth.

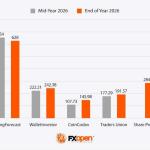

Some graphs show the future

Analysts have high expectations for NVIDIA stock price targets in 2025, driven by strong financial performance and strategic growth initiatives. Analysts forecast NVIDIA’s full-year revenue to reach approximately $111.3 billion in 2025, a significant increase from the $26.97 billion reported in 2023. Earnings per share (EPS) are projected to rise correspondingly, reflecting the company’s continued profitability and operational efficiency.

2025

2026

2030

Future Outlook

NVIDIA’s future looks promising with continued growth in AI, data centers, and emerging technologies. Price outlooks are bold, and NVIDIA will certainly remain an interesting player to watch in the coming years. For those interested in capitalizing on these opportunities, consider opening an FXOpen account to start trading NVIDIA and other stocks via CFDs.

The information of the following decade will challenge the versatility of Nvidia just as much as its technological capabilities. Now worth more than $4.1 trillion in market share, with a margin of an astronomical nature, and dominating the world of AI, it is legendary at the same time, as it is in constant danger of being overtaken by the next generation of disruptors.

Nvidia can continue to generate returns that would beat the market, particularly in the future when it has already established niches in robotics, autonomous cars, and quantum computing with long-term investors. However, risks are increasing: concentrated product base, increased customer independence, and increasing competition parties require continuous innovation.

In brief, the near future of Nvidia will rely on its capability to redefine itself without losing ground. To investors who put their money on the future direction of AI and automation, having Nvidia on the radar is just as essential as it has ever been.

Discover more from Being Shivam

Subscribe to get the latest posts sent to your email.