Microchip Leader Power Play

All digital growth i.e., AI and cloud services, auto and consumer electronics are based on microchip shares. Nvidia, AMD and Intel do not only have enormous capitals on the market, but diverge in terms of attitude to innovation, risk psychology and investment psychology.

They have an aggregate industry level challenge and firm specimen opportunities available in their price history, as well as technical indicators.

Chip stocks were able to withstand volatility in 2025 imposed by changes in trade policies, AI industry competition, and unstable interest rate market. Nvidia (NVDA) and Advanced Micro devices (AMD) have surpassed Intel (INTC), but all are overly sensitive to Fed policy, by rotation, to quarterly earnings surprises.

Technical Outlook

It is now characterized as an AI infrastructure since Nvidia provides data center drivers to autonomous cars. NVDA is technically robust going into Friday:

The stock has been trading on an important support break and creating a very strong foundation to the buyers.

The development of a powerful bullish reinforcement would be observed by the break of the current price above the mark of $185 and this would likely drag the price to the psychologically significant point of $200.

Despite the turbulence of the value market Nvidia enjoys the extensive support of passive investing funds and index funds. This institutional ownership stabilizes and makes short-sellers take steps prudently and this discourages any future backward push.

What Drives the Bulls

US chipmaker reports revenue of $46.74bn for second quarter, defying fears that AI may be overhyped shows the explosive rise in usage of artificial intelligence.

The strategic partnership with the hyperscale providers of cloud computing and its perpetuated expansion into edge computing have positioned NVDA to become the industry leader of the chip industry by default.

Nvidia Corporation reported its Q4 FY 2025 results, delivering record revenue of $39.3 billion (+3.4% above consensus estimates), up 78% year-on-year (YoY). Non-GAAP gross margin declined to 73.5%, down 3.2 percentage points YoY. Non-GAAP operating income reached $25.5 billion (+4% above consensus estimates), up 73% YoY, with an operating margin of 64.9%, contracting from 66.7% in Q4 FY 2024.

Non-GAAP net income rose 72% YoY to $22.1 billion (+5.7% above consensus estimates), while non-GAAP diluted earnings per share (EPS) increased 71% YoY to $0.89, which beat street expectations by 5.5%. The Steady Glide Above the Pullback of AMD.

Technical Analysis

Agile innovativeness has become the bead of hope that AMD has pivoted its name on, in the desire to bridge the performance gaps. In spite of the fact that the stock has declined after reaching an all-time high earlier this summer, pre-market trading on Friday indicates a revived investor interest:

AMD is dancing around the 50-day exponential moving average (EMA), i.e., a bull versus a bear.

Overall Average Signal calculated from all 13 indicators. Signal Strength is a long-term measurement of the historical strength of the Signal, while Signal Direction is a short-term (3-Day) measurement of the movement of the Signal.

The high level of support is the downside support at the position of 150 that is an important psychological and technical support. Relatively speaking, compared to NVDA, the situation of AMD is worse in the mind of institutional investors. It means both steeper gains in bull markets as well as more pronounced losses in periods of industry-wide decline.

Previously, AMD had just been victorious in a next generation AI processors design contest with Meta and Amazon, making its presence more noticeable and potentially capturing an even larger market share.

AMD announced financial results for the second quarter of 2025. Second quarter revenue was a record $7.7 billion, gross margin was 40%, operating loss was $134 million, net income was $872 million and diluted earnings per share was $0.54.

On a non-GAAP basis, gross margin was 43%, operating income was $897 million, net income was $781 million and diluted earnings per share was $0.48. Excluding these charges, non-GAAP gross margin would have been approximately 54%.“We delivered strong revenue growth in the second quarter led by record server and PC processor sales,” said Dr. Lisa Su, AMD Chair and CEO.

Intel

Intel which was the undisputed leader of the chip market is now aimlessly lost in mergers. The recent trading history of the stock can be characterized as some form of pennant formation in which the stock is more sluggish, the price range tightens, and both investors and traders are expecting some form of a decisive exit of the stock:

The lateral shift has left several investors completely frustrated and it has cast doubt on whether or when Intel will ever be able to regain its leadership or not.

Basic Problems at Intel

The problem of laggards is not a problem of charts, but fundamentals. Intel has been underwhelming in regard to being late to match Taiwan Semiconductor Manufacturing Company (TSMC) on the process node and had underperformed regarding keeping the high-value data center share.

However, a ray of light still passes in one way or another. The way forward into the future has to be done by the undertaking of developing its own foundry with the help of the necessary strategic U.S. federal grants.

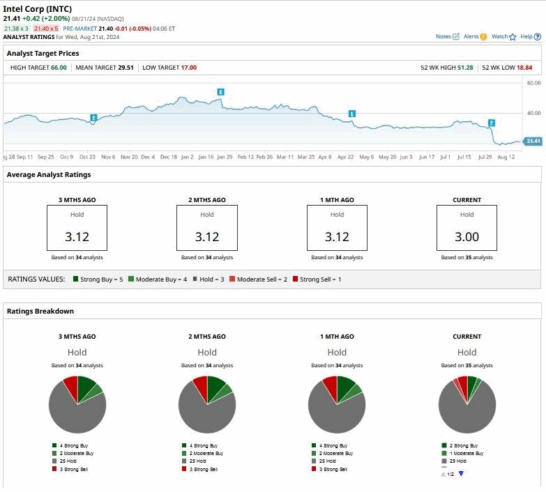

Analyst sentiment toward Intel stock which was quite tepid already soured even further after the disastrous Q2 earnings. Just over 11% of the analysts covering Intel rate it as a “buy” or higher, while the corresponding number 1 month back was nearly 18%.

INTC has a consensus rating of “hold” from the 35 analysts covering the stock, while the mean target price of $29.51 is nearly 38% higher than the previous one.

Psychology of Investors and Cuts in Rates

It is unquestionable that the interest rates have been sensitive to the stock of chips. A decline in rates creates risk-on and growth stocks like NVDA and AMD become more human. Macro optimism prevails over micro reality in terms of moving the investor psychology today. Institutional allocators, hedge funds, and retail traders have signaled panic among the analysts that the portfolios are re-seizing the new epoch of technology success.

Passive index funds continue to repurpose the semiconductors and have a large share of Nvidia and AMD. Friday session is gratifying small chip industry trends in 2025. The swings are no more during mid-summer periods, and there is concern that traders still believe that there are unexpected turnarounds that are related to earnings, guidance as well as regulatory intelligence.

Future Catalysts Past Friday

In addition to this Friday trade, Nvidia, AMD and Intel all have close exposure to several material themes:

- New AI Boost Competition: Designing intelligent deep learning machines, data center chips and basing outliers will grab the headline in the industry. Affection will be inherently driven with the upcoming Nvidia products, and statements related to relations with AMD.

- Global Supply Chains: Semiconductor industry continues to be marred with troubles that consider advanced lithography, resilient supply chain or localization. The US and EU are already bringing billions of dollars domestic capacity and this directly impacts the growth and positioning of Intel foundry.

- Regulatory Environment: It will be affected by the ongoing discussion on international restrictions on export to China, antitrust and anti-correlation, and by the fact that cybersecurity has become a necessity. The most agile firms in regards with adhering will minimize the disruptions.

- Earnings and Guidance: October will experience massive projected earnings. Check health indicators of the business-like gross margins, R&D expenditures and channel stocks.

- Rate Policy: The Fed will be setting the quantity of risk-taking in the sphere in its tone following the cut. dovish signals could upgrade high-beta stocks, which show propensity to rise (NVDA, AMD, etc.), then Intel can take advantage of a bigger change of values when the macro writers

Conclusion

Nvidia, AMD, and Intel are the three giants of the semiconductor sector that have their advantages and disadvantages that define their future. Nvidia dominates the industry with its leadership in artificial intelligence processors and computing servers with record turnover due to higher demand for their graphics cards and a resilient software platform that supports AI innovation.

AMD has had a distinguishing front in its competitive server and PC processors, even growing its data center footprint and a calibrating AI accelerators development, whereas it is more unstable in comparison with Nvidia.

Intel, which used to reign as the uncontested market leader, is struggling with basic head winds, including inability to dominate and lead process technology and lost market share in the data center segment; however, the promising nature of its significant foundry investments led and with strategic federal technology grants provides the prospect of regaining competitiveness.

The odds are on Nvidia due to the strong growth and institutional strength and AMD stands as a close competitor as a result of its recent AI revolt, whilst Intel is still struggling under stress but has potential to recover through its restructuring process.

On the whole, AI demand, supply chain effectiveness, and Federal Reserve rate policies are major factors affecting the near-term dynamics in the chip industry, and upcoming earnings reports and political trends are significant to define the direction of each company operating in an ever-changing environment.

Discover more from Being Shivam

Subscribe to get the latest posts sent to your email.